The semiconductor equipment manufacturing industry is in the midst of a dramatic transformation, with seismic shifts in market share, regional dependencies, and investment strategies. In this ever-evolving landscape, Innovent Technologies stands as a dependable partner, equipping its customers with the tools to face these challenges head-on. This article explores the dynamic changes in the semiconductor equipment manufacturing industry and the role that Innovent plays in ensuring its customers’ needs are not just met but exceeded.

Semiconductor equipment manufacturing Industry in Flux

The semiconductor equipment manufacturing industry is a critical component of the global technology ecosystem. In recent years, the industry has witnessed significant changes, and 2022 through the beginning months of 2023 was no exception. U.S. semiconductor device players, while increasing their market share to 53%, have faced a gradual erosion of added value. Their global market share has steadily declined to 32%, largely due to their reliance on a single player in Taiwan.

This dependency raises concerns, particularly due to Taiwan’s geopolitical status as a disputed territory. The prospect of a military conflict with mainland China could potentially cut off this vital supply chain. In response to these challenges, various efforts are underway, shaping the industry’s future.

- U.S. Reshoring: The United States is leading a concerted effort to reshore semiconductor foundries. This initiative seeks to bolster domestic production and reduce reliance on overseas suppliers.

- China’s Emergence: Mainland China has emerged as a formidable semiconductor player, with a significant industry plan involving an investment of $143 billion by 2025. This move underscores China’s ambition to establish itself as a major player in the semiconductor market.

- Capital Expenditure: The semiconductor industry’s growth has relied on substantial capital expenditure (capex), with approximately 20% of revenue dedicated to establishing new foundries every year. Over the next three to five years, an estimated $800 billion of fab-related investments are expected globally, corresponding to the 20% mentioned earlier.

Semiconductor Equipment Investment Landscape

The U.S. and the European Union are key players in this semiconductor equipment investment landscape. In the U.S., investments worth $205 billion are planned, with notable projects like the $40 billion TSMC fab construction in Arizona. U.S. players represent 60% of the investments in the country, including Intel, Texas Instruments, Micron, and Wolfspeed. Direct foreign investments (DFI) from companies like Samsung, SK Hynix, NXP, Bosch, and X-FAB make up the remaining 40%.

In the EU, $61 billion of investments are in the pipeline, with projects like the $20 billion Intel fab construction in Germany and a Global Foundries-STMicroelectronics fab in France. However, DFI dominates the EU landscape, representing 85% of investments, leaving EU players with just 15% of the pie.

Looking at the broader picture, announcements made in other regions, particularly Korea and Taiwan, indicate that the U.S. will receive 26% of total investments, and the EU will secure 8% of the total.

Semiconductor wafer production is expected to grow by 30% by 2028, reaching a total capacity of approximately 12,000kWpm 12’’eq. This growth highlights the continued expansion of semiconductor equipment manufacturing. The key question remains: at what rate will this growth occur?

Challenges effecting the Semiconductor Fabrication Companies

Continued investment in innovation is critical to semiconductor growth, including metaverse, digital health, mobility, and sustainability.

Three-quarters (76%) of semiconductor executives expect the industry’s supply chain challenges to ease by 2024, yet companies need to be prepared to withstand other market pressures by focusing on investments that will help drive future growth, according to a new study from Accenture (NYSE: ACN).

The report, titled “Pulse of the Semiconductor Industry: Balancing Resilience with Innovation,” is based on a global survey of 300 senior semiconductor executives who evaluate their companies’ supply chain outlooks and innovation roadmaps.

The executives cited challenges that could affect their ability to innovate even as the lingering effects of COVID-19 on the supply chain lift. The other challenges identified most often were geopolitics (cited by 48% of respondents), cybersecurity threats (42%), the changing competitive landscape (39%) and talent shortages (35%), among others. Faced with a changing industry landscape, two-thirds (65%) of the executives said they believe that the rate of Moore’s law — in which the number of transistors in an integrated circuit doubles about every two years — will slow down by 2024. In addition, 56% believe that promoting strong IP protection and enforcement is one of the best ways to enhance the industry’s resilience moving forward.

The report identifies areas for investment that will drive future semiconductor growth, including:

The Metaverse – Two-thirds (67%) of executives believe that semiconductors are the most critical technology to the development of the metaverse, and 44% of executives expect to allocate more than 20% of their semiconductor production budget to the metaverse by 2024.

Digital Health – Fitness trackers and smart watches represent the biggest growth opportunity for the industry, as these popular devices will benefit most from improved connectivity enabled by semiconductors.

Mobility – Extended chip shortages and cost concerns are cited as the biggest roadblocks to mobility’s future, leading 93% of executives to believe that car manufacturers should partner with semiconductor and technology businesses to develop next-generation mobility technologies.

Sustainability – More than nine in ten executives (93%) believe that sustainability initiatives will have a positive impact on profitability and create more sustainable consumer products. Sustainability was also cited as the area most likely to play the largest role in the semiconductor value chain within the next five years.

Credit to: Yole Group and Silicon Semiconductor

Discover the power of readiness with Innovent! We understand the crucial link between our proactive approach and our customers’ ability to effectively respond to the anticipated surge in demand for semiconductor devices and for the equipment that makes it possible to manufacture those devices. in the coming years. We’ve anticipated the challenges you’ll be facing and have developed a process to minimize the impact of those challenges. In doing so, you’ll be well prepared to stay ahead of meeting and exceeding your customers’ expectations.

Customer-Centric Approach:

At Innovent, we don’t just provide services; we immerse ourselves in your world. Our customer-centric approach is a commitment to understanding your business and products deeply. We become more than a service provider; we take the time needed to transform into a seamless extension of your organization. This unique alignment ensures that not only are your needs met but that our culture resonates with yours, fostering a relationship that goes beyond mere transactions.

Dedicated Expertise; Local Advantage:

Experience a personalized touch right from the beginning of our partnership. Innovent is a small, privately owned contract manufacturer, and prides itself on hiring locally. Our team is comprised of individuals with extensive backgrounds in semiconductor equipment companies. The majority of our staff bring years of invaluable experience, gained from working with or for similar companies and the equipment they manufacture. This local advantage ensures that the assigned Customer Representative, chosen at the project’s initiation, becomes a reliable resource throughout the entire life cycle of your project. With a high retention rate, you benefit from a consistent and experienced point of contact, enhancing communication and project continuity.

Operational Excellence; Cost-Efficiency, Minimize Time to Market:

Innovent excels at optimizing operations to drive cost reductions. Engaging directly with your teams, we refine supply chain management, manufacturing processes, and product designs. This hands-on collaboration ensures that specifications are accurate, and development is timely, maximizing the efficiency of your investment. Our commitment to operational excellence is a promise to deliver not just products but solutions tailored to your unique requirements. Innovent’s Manufacturing Engineers support our contract manufacturing services. They focus on ensuring we properly absorb, document, and produce your products to your specifications with efficiency. Our MFEs are experts in cost reduction achieved through manufacturing process refinements and product redesign. ISO 9001:2015, IPC620 and UL508A certified processes are used throughout our facility. Innovent develops and maintains process controls within all of its manufacturing operations. Our foresight gets you to market faster with fewer trials.

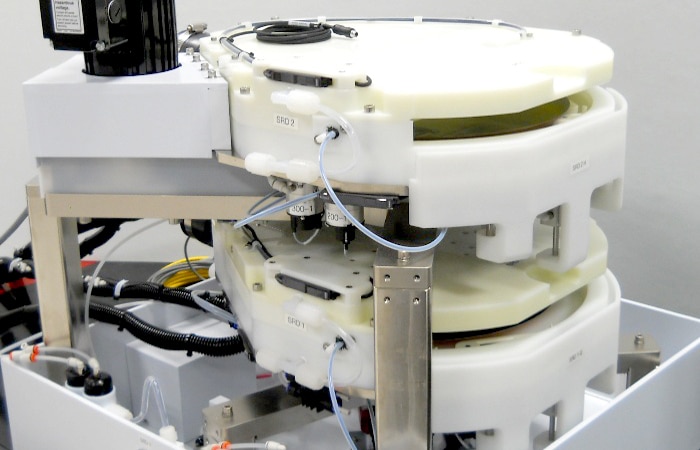

Vertical Integration; Precision Machining & Clean Room Mastery:

Elevate your manufacturing experience with Innovent’s state-of-the-art facilities. Most customers choose us for a combination of our unique manufacturing capability and the vertical integration we can provide for their OEM semiconductor manufacturing equipment. Solving the hard tight tolerance precision machining work that must be done right is why customers come back to Innovent. Raw material is transformed into highly refined components through our CNC precision machining centers, welding, and polishing processes. Some of those components move on to our clean work cells, depending on customer requirements for assembly, testing and qualification on larger tools and system. Our clean rooms adhere to ISO 5, 6 and 8 cleanliness levels, setting the industry standard. Innovent is your comprehensive solution by providing engineering services, precision machining, and cleanroom assembly all under one roof. This integrated approach frees you to direct your attention to the intricate intellectual property issues of your larger projects and equipment, confident in the knowledge that your manufacturing needs are expertly managed.

Conclusion

In a semiconductor equipment manufacturing industry marked by change and growth, Innovent Technologies LLC is a steadfast partner for its customers. By focusing on customer-centric solutions, efficiency, and a comprehensive approach to manufacturing, Innovent ensures that its clients are well-prepared to thrive in the dynamic semiconductor landscape. With a commitment to excellence, Innovent embodies the best practices of large corporations while remaining agile and cost-effective. As the semiconductor equipment manufacturing industry evolves, Innovent stands as a reliable bridge between innovation and production.